The Home Renovation Tax Incentive (HRI) scheme was announced in the Budget 2014 and will run from 25 October 2013 to 31 December 2015.

This incentive provides a tax relief by way of an income tax credit at 13.5% of qualifying expenditure on:

• repair

• renovation or

• improvement works.

This includes extensions, garages and attic conversions; the supply and fitting of kitchens, bathrooms and built-in wardrobes; fitting of windows; plumbing, tiling, rewiring and plastering.

To qualify for the HRI, you must be an owner-occupier and the work must be carried out on your principal private residence.

Any contractor you use must be registered for Value Added Tax (VAT) in Ireland and be tax-compliant. If several contractors, such as a builder, a plumber and an electrician, carry out qualifying work on your home, you can combine the cost of the works to make up the minimum qualifying amount.

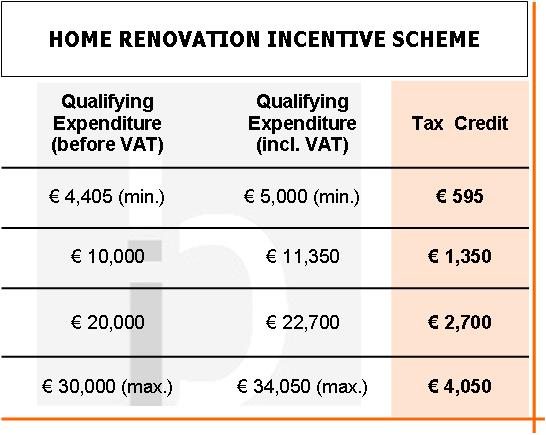

Have a look at the table below to see some examples of the tax credit you can get.

The works must cost a minimum of €4,405 (before VAT), which will attract a credit of €595. Where the cost of the works exceeds €30,000 (before VAT), a maximum credit of €4,050 will apply.

The works must cost a minimum of €4,405 (before VAT), which will attract a credit of €595. Where the cost of the works exceeds €30,000 (before VAT), a maximum credit of €4,050 will apply.

Example 1

You hired a builder to carry out a bathroom renovation for €10,000 (before VAT at 13.5%). The work was carried out and paid for in April 2014. Your builder entered the details to the electronic HRI system.

You hired a painter to carry out internal and external painting for €2,000 (before VAT at 13.5%). The work was carried out and paid for in September 2014. Your painter entered the details to the electronic HRI system.

You claim your tax credit in January 2015. Your tax credit is €12,000 x 13.5% = €1,620. You receive your tax credit of €810 in 2015 and €810 in 2016.

Example 2

You paid €7,048 plus VAT (at 13.5%) of €952 = €8,000 for repair works and an insurance payment of €6,000 was received in respect of the repair works.

The qualifying expenditure of €8,000 will be reduced by €6,000.

Leaving €2,000 (€8,000 less €6,000) qualifying expenditure.

This €2,000 includes VAT of €238.

The tax credit can be claimed on the €2,000 less €238 = €1,762 (before VAT).

Example 3

€8,810 plus VAT (at 13.5%) of €1,190 = €10,000 was paid for external wall insulation.

€2,700 was received under the Better Energy Home scheme grant.

The €10,000 will be reduced by €8,100 (€2,700 x 3) leaving €1,900 (€10,000 less €8,100) qualifying expenditure.

This €1,900 includes VAT of €226.

The tax credit can be claimed on the €1,900 less €226 = €1,674 (before VAT).

Example 4

You paid €5,000 (before VAT) to a VAT registered and tax compliant electrician for rewiring your home, your tax credit is €5,000 x 13.5% = €675.

Example 5

You paid a VAT registered and tax compliant builder €40,000 (before VAT) for an extension on their home

The tax credit is €30,000 x 13.5% = €4,050.

Examples of repair, renovation or improvement works that qualify under the Incentive:

- Painting and decorating

- Rewiring

- Tiling

- Supply and fitting of kitchens

- Extensions

- Garages

- Landscaping

- Supply and fitting of solar panels

- Conservatories

- Plastering

- Plumbing

- Bathroom upgrades

- Supply and fitting of windows

- Attic conversions

- Driveways

- Septic tank repair or replacement

- Central heating system repair or upgrade

- Supply and fitting of built in wardrobes

The VAT rate on works carried out must be 13.5%.

Please note the above is not a complete list.

What type of home qualifies?

A qualifying home is:

- A Homeowners main home, which the Homeowner must own and live in or

- A second hand home, which the Homeowner has bought and will live in as the Homeowner’s main home after the works have been carried out. (A complete reconstruction of an uninhabitable house does not qualify).

Please check the Revenue website for more information.

Leave a Reply

You must be logged in to post a comment.